The #1 Chart Reading Mistake Futures Traders Make (And How to Fix It)

The #1 Mistake Traders Make When Reading Charts

(And Why It’s Costing Them Real Money Without Them Realizing It)

Most traders don’t blow up their accounts because they’re reckless.

They blow them up because they’re confident… way too confident… way too early.

Here’s what I mean.

Imagine you want to cook a really good meal. You scour blogs for the perfect recipe, gather all the ingredients, follow each step, and nail it.

The food tastes amazing.

Now, is the next logical step to open a restaurant?

Of course not.

But that’s exactly how most new traders approach chart patterns and technical analysis.

When the Market Feels Easy, Skill Gets Confused With Luck

Back in late 2020, it felt like anyone could trade.

The panic sell-off was over, stimulus checks were flying, and trading apps were exploding in popularity. TikTok was full of people yelling “just buy the dip,” and honestly… it worked.

Because the market only had one direction to go.

When trading feels easy, new traders mistake luck for skill.

And when the market eventually shifts?

Those same traders give back their gains just as quickly as they made them.

I Made the Same Mistake

When I started, I was obsessed with every pattern I learned.

Trendlines went on every chart.

Head & Shoulders, Flags, Triangles. I saw them everywhere.

And every new tool felt like I’d finally cracked the code.

But here’s the truth:

I wasn’t mastering patterns. I was forcing them.

And the market punished me fast.

There’s a name for that stage - the Peak of Mount Stupid - where confidence skyrockets way ahead of actual skill. I've spent more time on that peak than I'd like to admit.

The Stoics said it best:

“You can’t learn what you think you already know.”

That’s the trap I fell into, and the trap thousands of new traders fall into every single day.

The #1 Mistake Traders Make With Chart Patterns

Mistaking familiarity for mastery.

Just because you recognize a pattern doesn’t mean you understand it.

Just because you’ve seen a trendline doesn’t mean it’s tradable.

Just because a formation looks like a breakout doesn’t mean you should pull the trigger.

Most traders don’t have a chart problem. They have a confirmation problem.

How to Read Charts the Right Way

Real traders don’t rely on one signal.

Or one setup.

Or one timeframe.

Real mastery comes from multiple layers of confirmation lining up at the same time.

The perfect example?

World War II.

The D-Day Lesson Every Trader Should Learn

The success of the D-Day invasion came down to one thing:

Predicting the weather.

Eisenhower didn’t rely on one forecast.

He had three independent weather teams giving him completely different answers.

So he waited.

And only when all three finally aligned did he give the order to launch — a decision that changed history.

Success came from confirmation.

Most traders do the opposite.

They trust one chart, one pattern, one signal — and it costs them.

Trading Like a Professional: Build Your Confirmation Team

Don’t rely on a single chart.

Don’t rely on a single timeframe.

Don’t rely on a single pattern.

Trade like Eisenhower forecasted the weather:

Wait until the data agrees.

Here’s how I do it when I’m trading the S&P:

- A tick chart

- A 60-minute chart

- A daily chart

- A weekly chart

- A monthly chart

- And the VIX

Six different views.

All reading the same market…

But not always telling the same story.

My job is simple:

Wait until they align. Then strike.

That’s where high-probability setups live.

Not in “seeing” patterns, but in verifying them.

The Real Secret to Reading Charts Like a Pro

Collecting data isn’t enough.

You have to interpret it.

You have to learn when a pattern matters

and when it’s just noise.

You have to understand context, not just shapes.

And you have to stop trying to predict the market with a single magic indicator.

Mastery isn’t stacking more tools.

It’s knowing which ones matter and when.

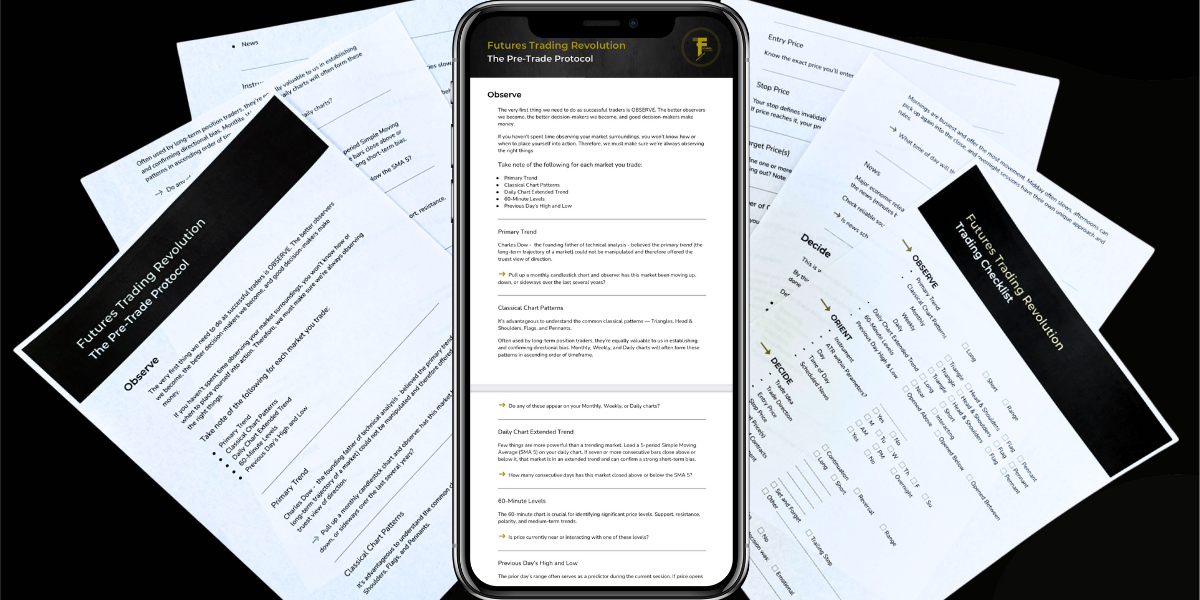

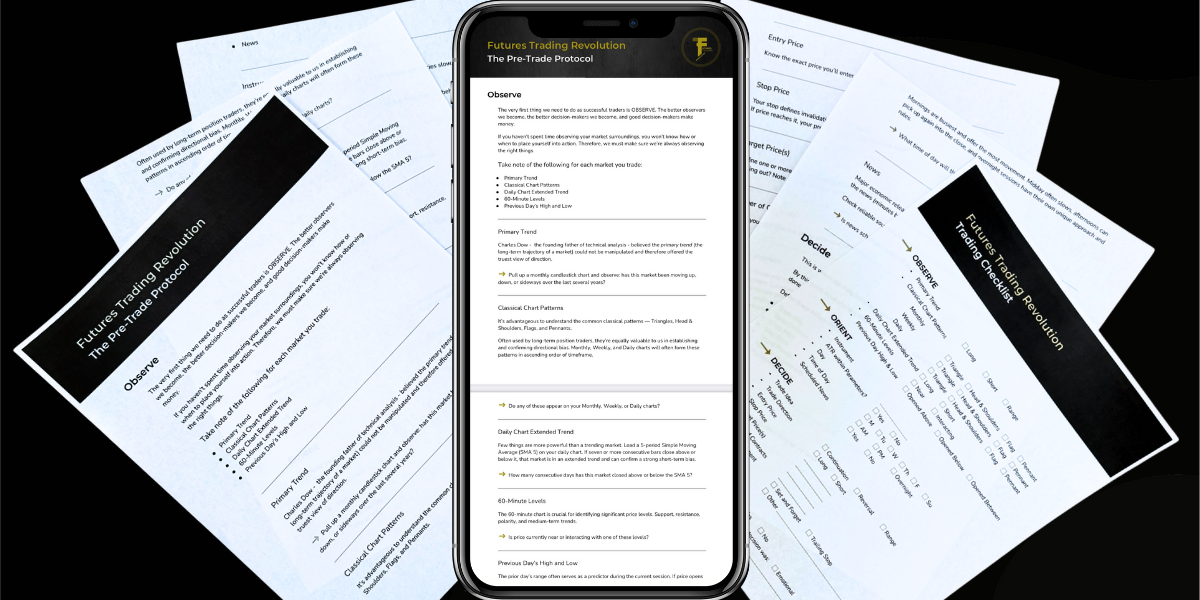

If you're ready to see what that looks like, click below to get the exact checklist I use to enter every trade with complete confidence.

FREE CHECKLIST: Stop second-guessing every trade and start trading with confidence.

Get the exact checklist pro futures traders use to eliminate risk, trade smarter, and spot profitable setups before they happen.